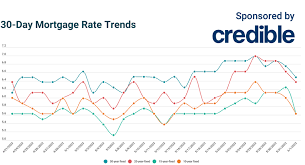

Keeping up with mortgage rates is crucial for homeowners and prospective buyers, as even small changes can have a significant impact on finances. In this article, we’ll provide you with an overview of the mortgage rates as of June 19, 2023. The good news is that rates have experienced a decline, presenting potential opportunities for individuals interested in buying or refinancing their homes.

Understanding Mortgage Rates

Before delving into the latest rates, let’s first understand what mortgage rates represent. Mortgage rates refer to the interest charged by lenders on mortgage loans. These rates determine the cost of borrowing money to finance a home purchase or refinance an existing mortgage. Rates can fluctuate daily due to various factors, including economic conditions, inflation, and the overall state of the housing market.

June 19, 2023 Mortgage Rates Update

On June 19, 2023, mortgage rates experienced a decline, creating an advantageous environment for borrowers. This decline can be attributed to several factors, including changes in the broader economy and the monetary policies of central banks. It’s important to note that mortgage rates can vary based on loan type, borrower creditworthiness, and other individual factors. Therefore, it’s always recommended to consult with lenders or mortgage professionals to obtain personalized information and rates.

Impact on Homebuyers

Lower mortgage rates can significantly impact homebuyers, making homeownership more affordable and accessible. When rates decline, borrowers may have the opportunity to secure a mortgage at a lower interest rate, potentially reducing their monthly payments. This can enable buyers to afford more expensive properties or provide breathing room in their budgets.

Refinancing Opportunities

For existing homeowners, declining mortgage rates present an excellent opportunity to consider refinancing their mortgages. By refinancing at a lower rate, homeowners can potentially save money on interest payments over the life of the loan or even shorten the loan term. Refinancing can also help consolidate debt, finance home improvements, or provide funds for other purposes. However, it’s essential to carefully evaluate the costs associated with refinancing to determine if it’s the right move for your specific situation.

Considerations for Borrowers

While declining mortgage rates are generally positive news for borrowers, it’s crucial to keep a few considerations in mind:

Market Volatility: Mortgage rates are subject to market fluctuations and can change rapidly. It’s wise to monitor the market regularly or consult with a mortgage professional to make well-timed decisions.

Personal Finances: Mortgage rates are influenced by individual factors, such as credit scores, income, and debt-to-income ratios. Maintaining good credit and managing your finances responsibly can improve your chances of securing favorable rates.

Mortgage Options: It’s essential to explore various mortgage options available in the market. Different loan programs, such as fixed-rate mortgages and adjustable-rate mortgages, have distinct features that cater to different financial situations. Understanding these options can help you choose the best mortgage for your needs.

Conclusion

Staying informed about mortgage rates is crucial for both current homeowners and prospective buyers. As of June 19, 2023, mortgage rates have experienced a decline, opening up opportunities for those looking to buy a home or refinance their existing mortgage. Lower rates can make homeownership more affordable and provide potential savings in interest payments. However, it’s important to remain vigilant, considering market volatility and individual financial circumstances. By staying informed and seeking guidance from mortgage professionals, you can make informed decisions and take advantage of favorable mortgage rates.