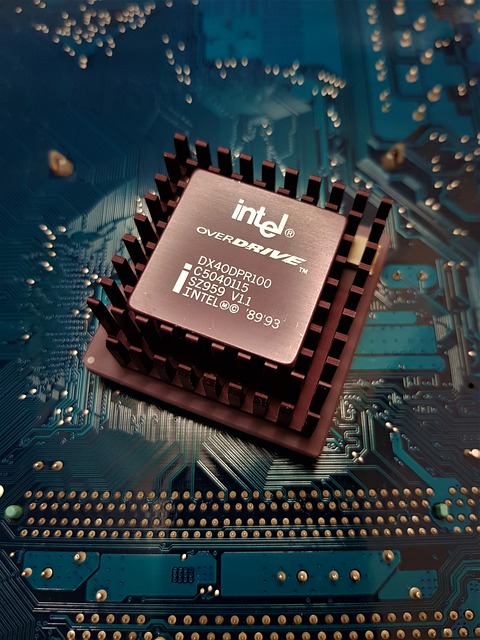

Intel, the prominent chipmaker, has witnessed a notable surge in its shares as the company expects second-quarter revenue to reach the upper end of its previously provided outlook. This positive market response indicates investor confidence in Intel’s performance, and the article emphasizes the optimistic revenue projections for the quarter.

The anticipation of Intel’s second-quarter revenue at the upper end of its outlook has instilled a sense of optimism among investors. The market response is reflected in the significant jump in Intel’s shares, demonstrating the positive sentiment surrounding the company’s performance.

The second-quarter revenue outlook is a crucial indicator of Intel’s financial health and market competitiveness. The fact that the projected revenue is expected to be at the upper end of the outlook indicates strong sales and potential growth opportunities for the company.

Investors are closely monitoring Intel’s performance, especially in the context of the highly competitive and rapidly evolving semiconductor industry. The positive market response to the anticipated revenue underscores the market’s confidence in Intel’s ability to navigate the challenges and capitalize on opportunities in the current market landscape.

Intel’s performance and revenue projections for the second quarter reflect the company’s efforts to meet customer demands and capitalize on emerging technologies. The chipmaker’s ability to deliver on its outlook showcases its commitment to innovation and adapting to the evolving needs of the industry.

In conclusion, Intel’s shares have experienced a significant increase as the company anticipates second-quarter revenue at the upper end of its outlook. The positive market response highlights investor confidence in Intel’s performance and its potential for growth in the semiconductor industry. As the company continues to navigate the evolving market landscape, the second-quarter results will provide further insights into its financial performance and market position.