AstraZeneca Q2 Results Surpass Estimates; COVID Vaccine Sales Take a Hit

The pharmaceutical giant AstraZeneca has recently released its second-quarter financial results, surprising analysts and investors with robust performance in many areas. However, it hasn’t been all smooth sailing, as the company faced headwinds due to declining COVID vaccine sales. In this article, we delve into AstraZeneca’s Q2 performance, analyze the factors that contributed to their success, and explore the challenges they encountered in the context of the ongoing pandemic.

AstraZeneca’s Q2 Financial Highlights

During the second quarter, AstraZeneca achieved an impressive growth rate that exceeded market expectations. The company reported strong revenue and profit figures, driven by the success of its diverse portfolio of pharmaceutical products. Key therapeutic areas, such as oncology, respiratory, and cardiovascular medicines, played a pivotal role in bolstering the company’s overall performance.

Factors Influencing AstraZeneca’s Success

AstraZeneca’s remarkable Q2 results can be attributed to several factors. First and foremost, their commitment to innovation and research and development (R&D) investments has paid off. The company’s ability to introduce new and effective medications has expanded its market share and positively impacted its bottom line.

Additionally, AstraZeneca’s global expansion and strategic partnerships have allowed them to tap into new markets and gain a competitive edge. Collaborations with other pharmaceutical companies, research institutions, and government agencies have facilitated the development and distribution of critical medications worldwide.

Furthermore, the successful management of supply chain challenges during the pandemic has enabled AstraZeneca to maintain a steady flow of essential drugs, mitigating potential disruptions that could have affected its financial performance.

COVID Vaccine Sales Dilemma

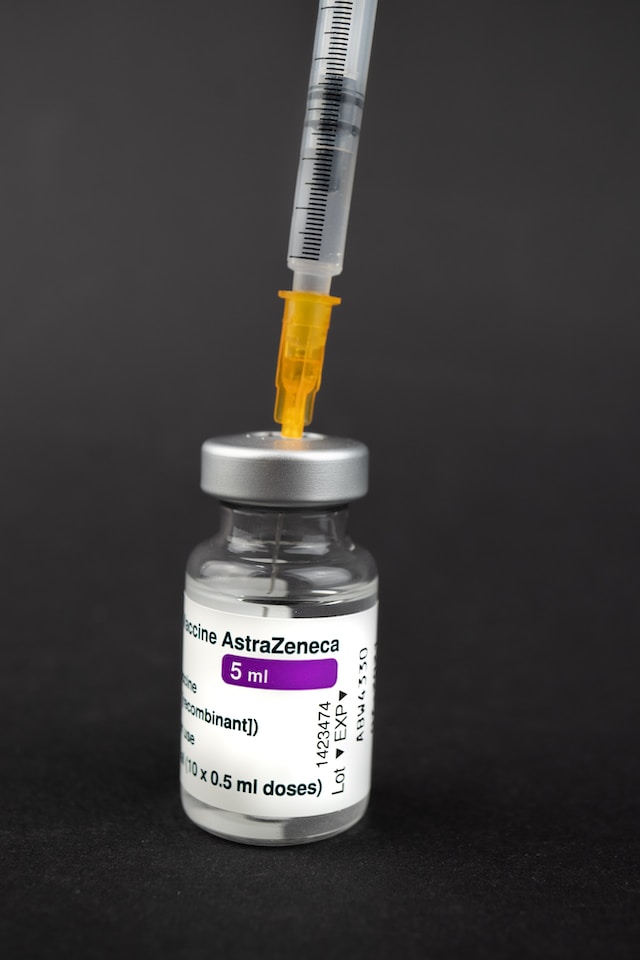

Despite AstraZeneca’s overall success, the company faced a significant setback concerning its COVID-19 vaccine sales. The initial demand for vaccines was astronomical, as governments worldwide rushed to secure doses to combat the pandemic. However, as vaccination rates increased and other vaccines entered the market, AstraZeneca experienced a drop in demand for its COVID-19 vaccine.

This decline in vaccine sales was partly due to increased competition from other vaccine manufacturers and concerns surrounding reported rare side effects. Additionally, some regions achieved higher levels of vaccination, reducing the immediate need for further doses.

Implications for the Healthcare Industry

AstraZeneca’s Q2 results and challenges provide valuable insights into the pharmaceutical industry’s current state and its response to the COVID-19 pandemic. The company’s ability to diversify its product offerings and sustain growth in non-pandemic-related areas demonstrates the importance of a well-rounded portfolio to withstand fluctuations in demand.

The decline in COVID vaccine sales highlights the need for continuous research and development to address emerging variants and future pandemics effectively. It also underscores the importance of maintaining public confidence in vaccine safety and efficacy, which can significantly impact vaccine adoption rates.

Conclusion

AstraZeneca’s Q2 results have undoubtedly surpassed estimates, showcasing their resilience in navigating challenges posed by the pandemic. Their commitment to innovation, global expansion, and supply chain management has proven successful in driving growth across various therapeutic areas.

While COVID vaccine sales have declined, AstraZeneca’s contributions to the global vaccination effort remain significant. The lessons learned from their experience will undoubtedly shape the future of healthcare and pharmaceutical industries, emphasizing the importance of adaptability, research, and maintaining public trust.

As AstraZeneca continues to make strides in developing groundbreaking medications, investors and stakeholders are eagerly awaiting the company’s next steps to sustain growth and drive positive change in the healthcare landscape.